What is Infinite Banking

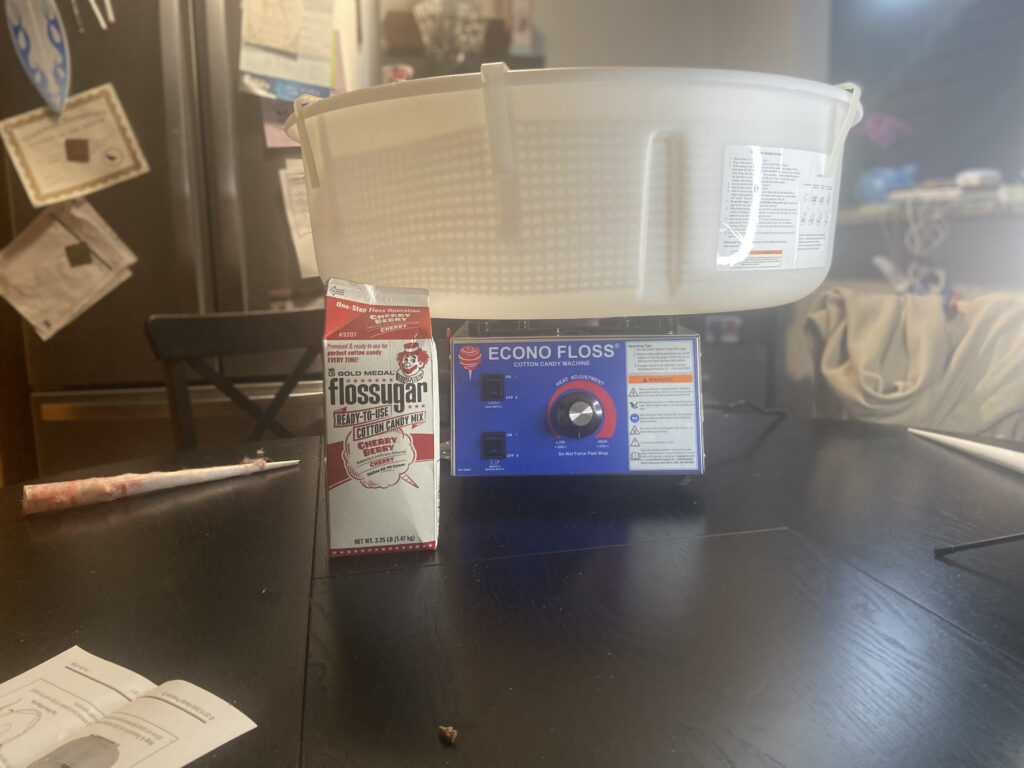

The Infinite Banking Policy or Infinite Banking Concept is a flashy marketing name for a special type of account. The account is specially designed Whole Life Insurance from a mutually owned insurance company. Now before you roll your eyes and click off, there are things you thought you knew about whole life and a bunch of things you never knew. I guarantee it. I recently used this account to fund a cotton candy machine for my party rentals business. For simplicity, think of this account similar to a savings account, but on steroids. You deposit money in the account in the form of premium payments, or deposits since this account will be acting as your bank. These deposits get split up into two buckets:

The Two Buckets

Bucket 1: Bucket 1 is the base. Money that goes into the base pays the insurance salesperson and builds money in the form of a death benefit.

Bucket 2: Bucket 2 is the Paid Up Additions (PUA). Money that goes into this bucket gets translated into cash value that the owner of the account can use.

Most boiler plate designs of this type of account have most of your money going into Bucket 1, the base. However, Infinite Banking flips the design the upside down with a large portion of the premiums going into the PUA (cash value) and a smaller percentage going into the base. Not all insurance agents will know how to design this sort of policy nor is it in their best interest. Insurance sales agents are mostly compensated by the base premium.

Why Use Infinite Banking

There are pros and cons to everything. Infinite banking is no exception, however I am thoroughly convinced this account is far superior to keeping your money in the bank, money market accounts, or even the stock market.

When you keep your money in the bank, you earn almost nothing on that money. Meanwhile, the bank takes your deposit and lends it out to consumers in the form of car loans, mortgages, refinances, and personal loans. It’s known as fractional reserve banking. Legally speaking, banks only have to keep 10% of whats deposited. The other 90% is is deployed to create greater cashflows. While you make nothing for keeping your money at the bank, they make around 400% on every dollar you put in; conservatively. This isn’t even taking into account the fees (maintenance, overdraft, etc) that banks charge.

The stock market is a step up in terms of places to park cash. The money does typically grow, but it also comes with giving up control, adding risk, and comes with its fair share of fees. Putting $400 a month into the stock market for 30 years may make you rich one day, but will your one day ever come? In recent years, I have more and more turned off by the stock market. With huge hedge fund managers and high frequency traders it seems like the everyday investor is playing someone else’s sport. With Whole Life Insurance you can invest your hard earned money into an interest bearing account, without fear of losing your principal and remaining completely insulated from the nonsense up and down swings of the market. Why not use your money now AND have it grow at the same time? That is what infinite banking can do.

Pros about Infinite Banking

Your money never goes down in value

In infinite banking, there is no risk of losing your principal. Zero. None. On top of that, your money earns a guaranteed interest rate as well as a dividend payout each year. This interest rate is usually between 3% and 5% plus end of year dividends which, added to your interest rate, can equal a rate of return of anywhere from 6% to 8% per year. Because we are buying this plan from a mutually owned Insurance company (meaning you and the other policy holders), the account is completely insulated from market swings.

Uninterrupted Compound Interest

This is my favorite perk. Money that you pull from your cash value doesn’t lower the lower the cash amount in the plan. Rather than withdrawing your cash, you are borrowing against your cash. I’ll explain:

Let’s picture that you are saving up for a car and that car is going to cost $25,000. You save $5,000 for 5 years and then use that money to purchase the car. What is your account balance after buying the car? If you’re following me, its 0. You spent all your money on the car.

Now lets look at this same case, but instead of saving $5,000 per yer in your bank, you save $5,000 per year in your infinite banking whole life policy. At the end of 5th year you take a loan against the cash value in your infinite banking policy. The money gets deposited in your account in about 1 day and you are free to use it as you wish. But, since you are borrowing against your cash value, your $25,000 in your infinite banking policy never leaves and therefore continues to grow uninterrupted compound interest. The money you borrowed has a low interest rate (usually between 4%-6%). You pay the money back on your terms when you want and with no effect to your credit score.

If that made sense to you, then imagine this: You are 10-15 years into having this policy and making premium deposits. Let’s say after 15 years you’ve accumulated $75,000. You take out a $25,000 loan at a 5% interest rate while your $75,000 sits in the account and continues to grow at 3%-7%. The interest on that $25,000 loan at 5% is about $1,250. The interest you are making on your $75,000 at 4% is $3,000. It’s literally not costing you anything to borrow that money. And this is using conservative estimates.

By the way, would you rather pay 5% interest on borrowing money or pay 15%-25% capital gains tax from selling stock? Borrowed money is cheaper and tax free.

Paying Loans Back on Your Schedule

Unlike borrowing money from your bank, you can decide when and how to pay your loan back to the policy. Need to skip of month of payments? Sure. Want to wait until next year to start making payments? Sure.

And all of this is done with no hit to your credit score, no applications to fill out, and no complete history of debt to income ratios, income verifications, job verifications, etc, blah, blah, blah.

Oh, and if you decide not pay the loan back- it’s ok. Any outstanding loans when you die simply reduces your death benefit by that amount. Pretty sweet, huh? This is how many people in retirement who have had this account in force for many years can provide themselves with a tax free income year after year. All while their cash value accumulates uninterrupted compound interest.

It Pays a Death Benefit

Let’s not forget that this a life insurance product. Another massive perk to this account is that it pays a death benefit to your family when you die. And as long as you keep up with your premium deposits your death benefit will NEVER expire. And the longer you keep your policy in force, the more dividends you’ll earn and the higher the death benefit goes year after year. And to boot, after 20 years you will likely not need to pay any other premiums as your cash value will earn enough interest and dividends to pay for themselves.

The fact that your family will receive a death benefit when you die, regardless of age, opens up a world of possibility for your current life. Think of all the freedom you can physically and mentally enjoy when you don’t need to worry about saving money for the next generation. The money will be there in the form of your death benefit.

Creditors Can't Touch It

Money in this account can’t be claimed by creditors. Cash Value in the account is also virtually invisible on an asset check. So, if you’re hoping your kid qualifies for financial aid when they go to college, nobody will be able to see what kind of money is being held in this account. The same goes for getting sued. The money in this account is untouchable.

Ways to Use the Policy

Instead of giving up control of my money by locking it up in the stock market for 20 years or having it sit at a bank while they make money hand over fist, I am funneling that money into my whole life insurance policy. That way it can grow and I can use it at the same time. I still have money invested in the stock markets, but I no longer see the stock market as my only hope for retiring. I’m diversifying between stocks, whole life, real estate and businesses.

I intend on using the cash value in my whole life to buy assets and pay the loans back with cash flow from those assets. In a few years when my cash value is big, I am going to use that money and lend it out to others at a higher interest rate- just like the banks do. There is a massive market for hard money private loans.

If you want to learn more about this, I suggest you watch some of this guy’s YouTube videos. He is a true master at explaining how this works. Cheers to banking on you!